Dark Clouds on the Horizon?

After all the trading drama from Gamestop last week, one of my children asked me to explain a short squeeze. I wax philosophic is one of those times when the irrational exuberance of investors would drive a stock up and up ever higher and higher. Investors see no logic for the stock's continued rise, so investors sell it short in the bet that the stock will go down. This is where greed and fear, the primary emotions that move financial markets, come crashing together.

My child said, "Okay, Dad, I sort of get that. But then what happens?" I said the short sellers are forced to buy back the stock they've shorted, which only drives prices higher, creating bigger losses for them. That's why it's called a short squeeze. The point is the whole dialogue about crazy stock prices and shorts felt very déjà vu to me, remind me of the kind of discussions before the pinnacle of the dot.com era when people ignored the warning signs of inflated values. Are we reaching that point again? We are now 11 years into a seven-year aging bull market. Last year at this time, over half of the major investment banks were estimating that there was a 50% chance of a market pullback. Now they're all talking about more stimulus and vaccines, which, while great news, only mask that there are some serious core issues.

Should you be concerned? Yes. Yes, because tech M&A, both pricing and volume, closely follows the overall markets. And when the markets turn, you will lose your best window to sell. While the stock market recovered quickly last spring during the massive government stimulus, we still haven't seen the true cost. Despite record stock prices, which also drove up private stock prices, things aren't really better. Today, we have nearly 11 million more unemployed, and many won't go back to work as the companies they work for go out of business or at least be leaner with a more virtual model. Some experts estimate that 60% of the businesses that closed through the pandemic are closed for good. They will not reopen. Many of these people have been unemployed can't pay their mortgages, creating real estate weakness, reminiscent of the 2008 financial crash. We have $2T more in government debt, and it looks like there's going to be a lot more of the future stimulus programs, that printing of money will lead to inflation.

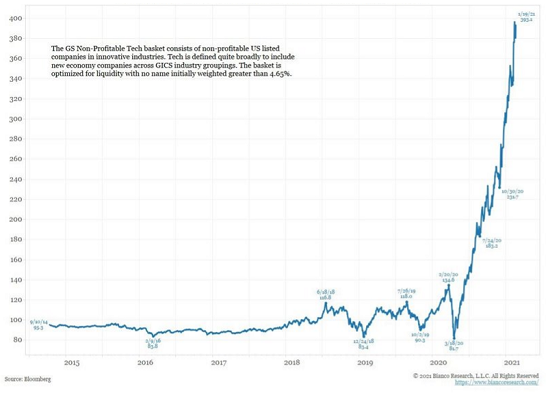

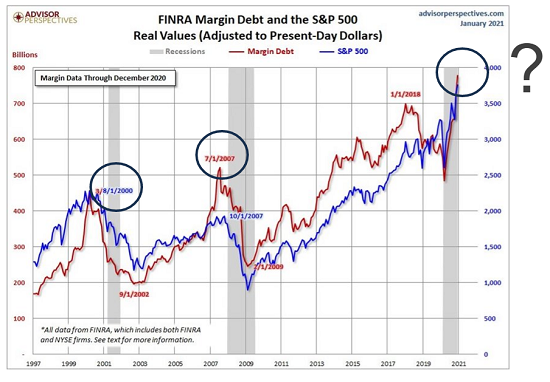

Many world economies have been brought to their knees, they're not going to bounce back that fast. And the charts have warning signals flashing red all over the place. Here's a couple of examples. Look at the number of tech companies right now that are not profitable, despite record valuations. They aren't making any money. Those valuations will not last forever. Then are the margin numbers from FINRA. You could literally take this graph and pinpoint the last major crashes from dot.com and '08. And from the looks of this graph, number three is not far away.

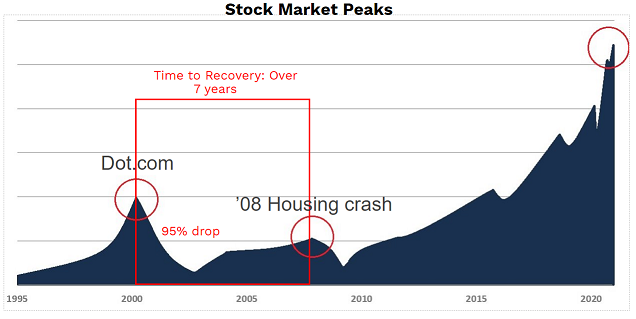

The point of this concern is that M&A is all about timing and once the market finally goes into this downward cycle, the value of your company is at serious risk. Valuations of private tech companies plummet 40% in 18 months, half the buyers disappear, less cash and deals waiting years for recovery. Tech M&A volume dropped 95% after the dot.com crash and bottomed three years later. The full M&A recovery took over seven years. Can you wait years for prices and volume to recover if that happens? I know you baby boomers can't. So, in conclusion, pay attention to the clouds ahead. Don't get caught missing the best M&A market in history.