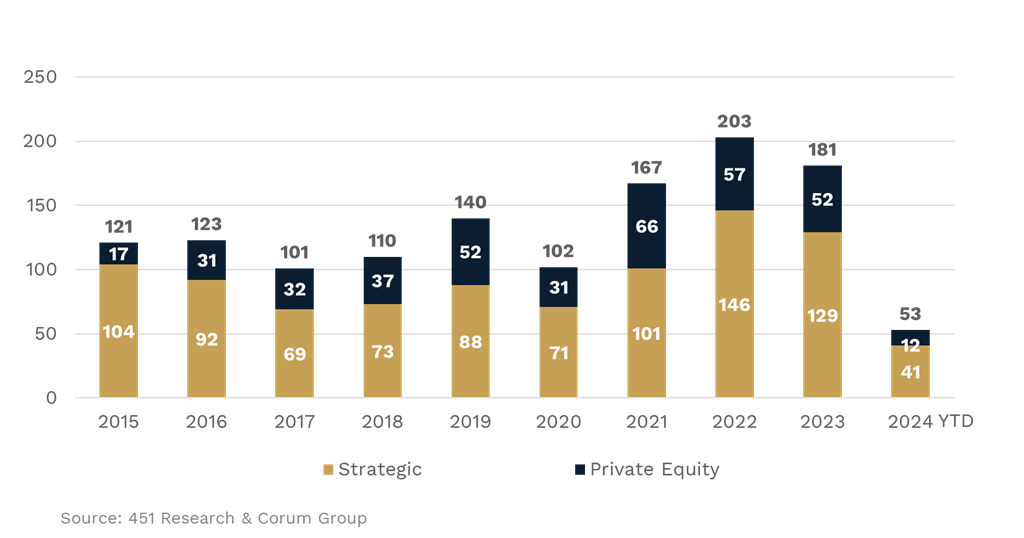

M&A transaction volumes in the Energy Tech market boomed from 2020 to 2023, rising by 77% to reach 181 deals. Both strategic and financial buyers are active in this space, with strategic firms seeking to bolster their in-house technical teams and financial acquirers aiming to buff up their platforms in the energy space. As competitive pressures grow, companies are further encouraged to find a partner with the reach and resources to remain competitive in this industry.

According to a study from Ernst & Young, 92% of oil and gas firms intend to invest in AI or plan to do so in the next two years. Exxon Mobil is using AI to automate manual tasks to improve safety and productivity. For example, the company can use AI to help detect leaks and flares. As the firm generates an enormous amount of data, Exxon Mobil is using AI to build intelligent systems to support geophysicists' decision-making processes and assist with seismic image processing.

Electricity companies are also making the most of AI by solving problems such as blackouts. The Chinese state-owned power grid company is using AI to support electricity distribution. In the residential community of Qitailu, the company deployed AI-powered sensors that can choose the most viable power supply routes. Should a failure occur, the system can automatically start fault location, fault isolation and power restoration activities that can fix a blackout in seconds instead of hours.

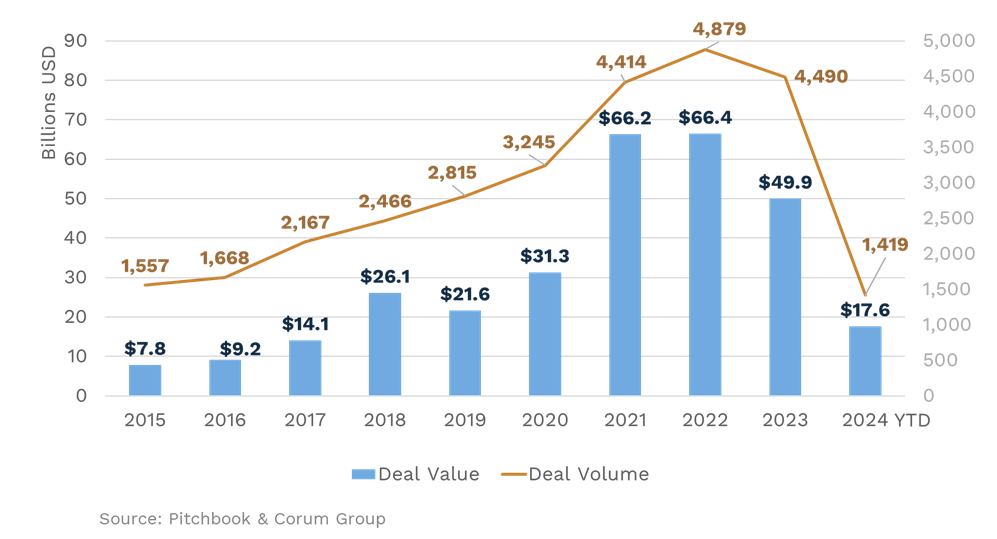

Venture capital funding for Energy Technology firms has dried up since peaking in 2022, encouraging companies to pursue M&A for growth and liquidity instead. From 2022 to 2023, venture capital funding for Energy Technology firms declined by 25%, and the number of deals dropped by 8%. This trend continued during the first five months of 2024, with deal values coming in at $17.6 billion and transaction volumes reaching just 1,419, compared to $49.9 billion and 4,490 deals in all of 2023.

The six trends driving M&A activity in the Energy Tech sector are grid optimization, AI, cybersecurity, decarbonization, enabling renewable energy and demand-side management. One example of these trends in action includes the purchase of Intersphere, a provider of AI-powered weather and climate forecasting software that enables renewable energy generation forecasts, by Climavision in April 2024 to provide its customers with deeper insights on how weather and climate will impact their operations.

Intermittent sources of power, such as solar and wind farms, are inherently difficult to predict as cloud cover, wind, storms, time of day and other factors profoundly impact energy generation. Forecasting how those factors will influence electricity generation enables power grids, traders and renewable energy operators to better prepare for the future. The acquisition of Intersphere highlights the demand that companies developing this type of technology are seeing in the market today.

Another side of the energy market involves managing power consumption to reduce fuel consumption and utility bills. Fusion Énergie, an AI-powered energy intelligence solutions provider specializing in energy management and optimization for hotels, condominiums and other businesses, was bought by Lemay in January 2024 to accelerate its efforts to decarbonize built environments by limiting energy consumption during the lifecycle of buildings.

Companies that map to any of the six aforementioned trends are seeing robust demand from deep-pocketed buyers. As the Energy Tech sector continues to consolidate, CEOs and founders should be prepared for increased competitive threats and should consider finding a partner.